Building moats in Climate Tech: A Guide to long-term value

Moat factors in Climate investing.

This post provides a brief overview of the factors that make climate tech companies intrinsically valuable. There's more to investing in climate tech than just making a profit. Some companies operating in the climate tech sector are making incredible contributions to the environment, and the intrinsic value from their work can benefit everyone in the long run.

Disclaimer: I hold investments in some of the companies mentioned, but this article in no way endorses them.

Let's examine some of the qualitative factors (rationales) that help firms working in the climate tech space build a moat and look at businesses that have done it successfully.

Manufacturing expertise as a competitive edge

Companies with a strong foundation in research and development (R&D), combined with deep expertise in manufacturing, often enjoy a significant market advantage. These "deep tech" companies—with hard-to-replicate skills, especially in production are poised to stay ahead of the competition. Tesla's recent moves to accelerate deep tech and manufacturing innovation are a prime example of this trend. In the semiconductor industry, the strategy of TSMC (Taiwan Semiconductor Manufacturing Company Limited) is a testament to the power of manufacturing prowess. TSMC has built a formidable barrier to entry through its expertise in producing advanced chips and the sheer cost and complexity of the required equipment. This has solidified its position as the world's leading chip supplier.

A deep dive into technology requires ongoing R&D to build a strong foundation. This provides a significant moat in terms of intellectual property (IP). The manufacturing layer further reinforces this moat, as producing novel technologies is an inherently challenging and iterative process.

But manufacturing advantages are not just limited to hardware or electronics. As global challenges mount, these capabilities are proving just as vital in other sectors, like food and agriculture. Climate change is taking a toll on crop yields, and labor shortages are becoming increasingly common in developing countries, affecting both agriculture and food service. To address these issues, companies with expertise in manufacturing food processing equipment and a focus on decentralized distribution will be highly sought after. These methods can guarantee a more sustainable food supply, boost productivity, and cut waste.

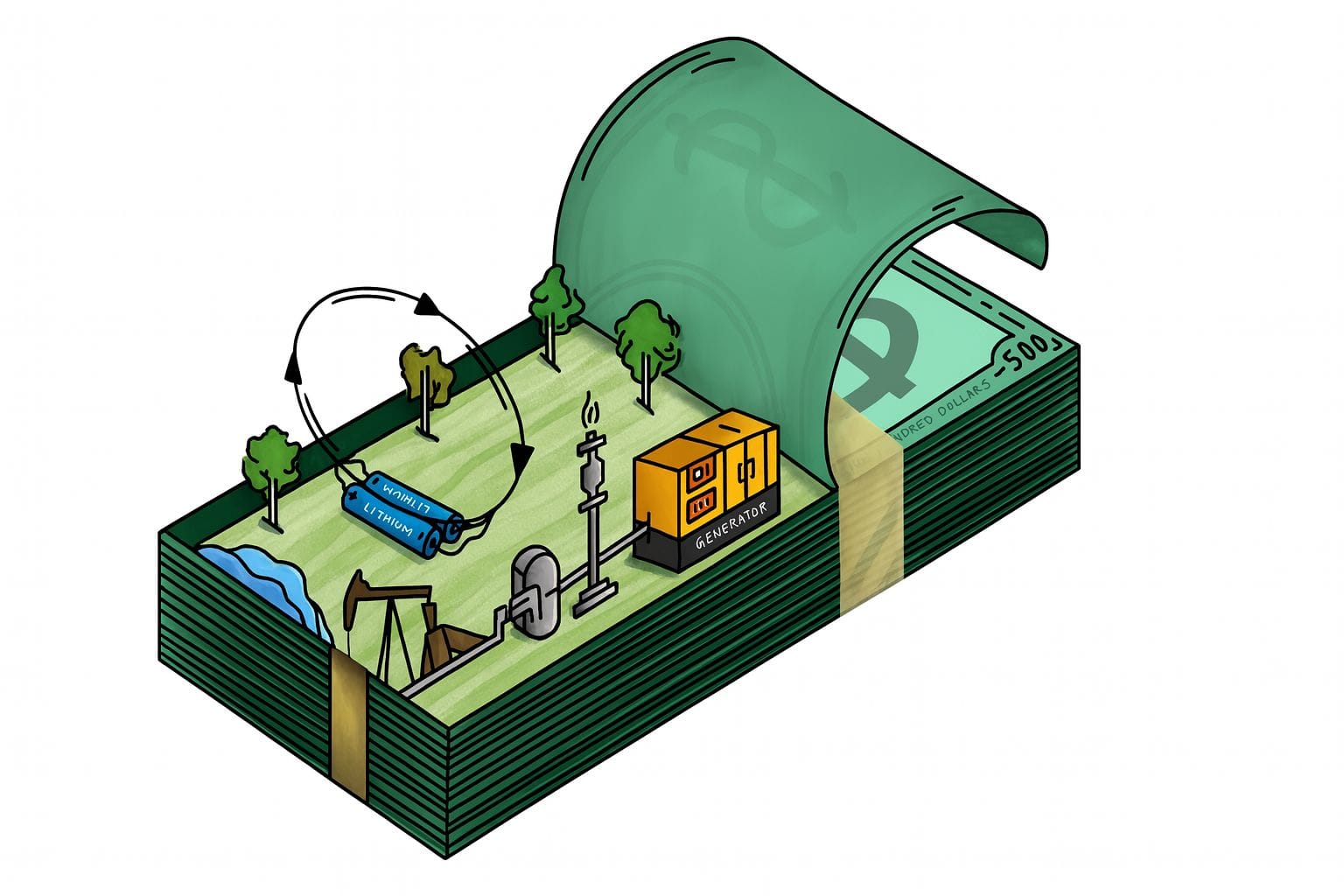

Upcycling: Circular economy in action

There’s an old saying, "One man's trash is another man's treasure." This perfectly captures the principle of the circular economy. The Ellen Macarthur Foundation defines the circular economy as a system where materials never become waste and nature is regenerated.

While a completely circular system is ideal, complete recovery and upcycling of materials are often impractical. However, a partial circular economy still offers significant benefits in terms of resource and energy efficiency.

Given the looming constraints on rare earth metals, critical minerals and the non-renewable nature of fossil fuel reserves, adopting circular practices has become increasingly imperative for businesses. Two US-based companies— Redwood Materials and Crusoe Energy are leading the charge in the energy sector.

Redwood Materials is creating a closed-loop supply chain for lithium-ion batteries, encompassing collection, refurbishment, recycling, refining, and remanufacturing. This approach significantly reduces battery waste in landfills.

Crusoe Energy's Digital Flare Mitigation (DFM) system is another innovative solution. By capturing wasted natural gas from oil fields and converting it into electricity to power modular data centers, DFM addresses the environmental issue of flaring (methane emissions) while also meeting the growing energy demands of AI commercialization. It provides a practical way to repurpose flared gas while cutting emissions in the oil and gas industry.

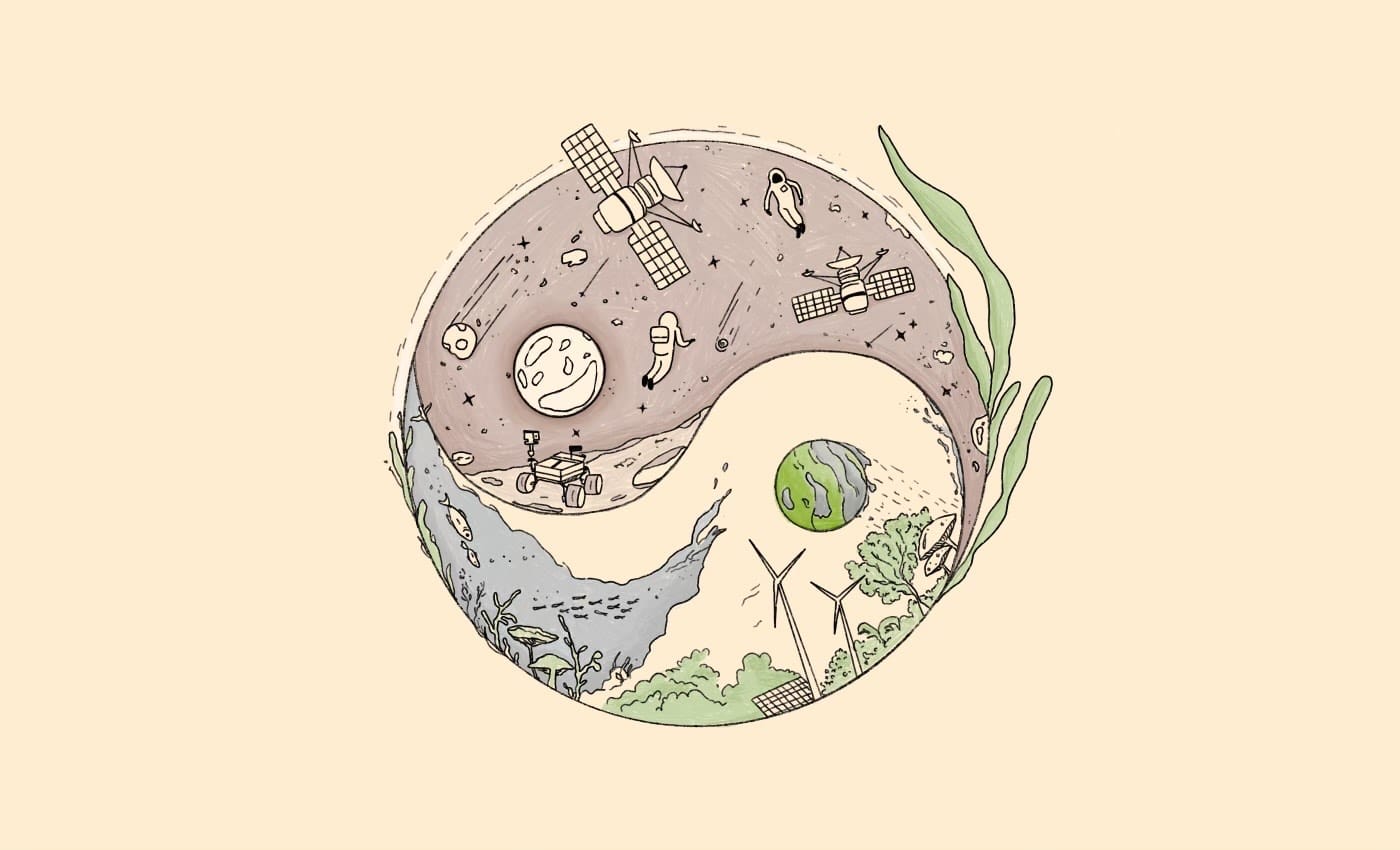

From Space to Shelves: Leveraging military and space tech

Companies that can harness the knowledge gained from space and military research often gain a significant competitive edge. Products designed for the extreme conditions of space are incredibly durable and reliable, making them well-suited for terrestrial applications.

History is filled with examples of innovations that originated in space or military research and later found their way into everyday life. NASA's inventions like freeze-dried food, memory foam, and wireless headsets, are just a few examples. Similarly, the internet, GPS, and microwave ovens all have their roots in military research. The urgent needs of these sectors often drive innovation and lead to groundbreaking discoveries. While many of these inventions eventually reach the public, it's often entrepreneurs who turn them into everyday tools, bridging the gap between breakthrough innovation and practical application.

The Smart Tire Company and Henson Shaving are two such companies that have successfully commercialized technologies developed for space applications. NASA created a super-elastic tire for Mars missions, designed to withstand extreme temperatures and challenging terrain. The Smart Tire Company adapted this technology for terrestrial use, creating an airless, durable tire made from a special shape memory alloy called Nitinol. This innovative tire offers a significant value proposition for vehicle owners, eliminating the need for maintenance or replacements.

Henson Shaving took a similar approach. It uses aerospace-grade aluminum to make eco-friendly and long-lasting razors, which offer a compelling alternative to disposable options. While their business model may not rival established players in the shaving industry, the long-term value they provide to customers is unmatched.

Battling tiny threats: Innovative solutions for micro-pollutant removal

Amid today’s consumer-driven landscape, it’s reassuring to see companies addressing urgent environmental challenges. The Tyre Collective, a UK-based startup, is developing technology to capture and monitor tire wear, a stealth pollutant that contributes significantly to microplastics in our oceans and air pollution in cities.

Their innovative solution is an electrostatic collector that attaches to the rear mud flap of vehicles. As the vehicle moves, the collector captures the tiny rubber particles emitted from the tires. Importantly, the device has minimal impact on fuel efficiency. The collected tire wear can then be recycled to create retreads for truck tires or upcycled into shoe soles, demonstrating the circular economy in action.

The Tyre Collective is currently piloting its device with Rivian, an electric vehicle manufacturer, and aims to eventually persuade regulators to include tire wear in vehicle emission standards. With the global number of vehicles on the rise, supporting firms like the Tyre Collective is a sensible step towards a cleaner planet.

Embrace interdisciplinary collaboration

The relentless pursuit of economic growth often creates siloed teams, causing organizations to overlook the powerful benefits of cross-functional collaboration. Many of the most impactful climate solutions emerge not from isolated genius but from unexpected partnerships across diverse disciplines.

Interdisciplinary collaboration not only supports both professional growth and employee well-being but also opens the door to unexpected discoveries. These "happy accidents" can lead to the innovation of new products and services, build resilience in challenging times, and expand a company's business options.

Balancing short-term profitability with investments in interdisciplinary projects can be difficult, but long-term rewards are substantial. By embracing a more collaborative and holistic approach, companies can position themselves for sustainable success.

Hedging your bets

When it comes to technology, investors often rely on the Technology Readiness Level (TRL) to de-risk their investments. Developed by NASA in the 1970s, TRL measures the maturity of a technology, from early-stage research to full-scale deployment. TRLs are based on a scale from 1 to 9, with 1-3 being the Research stage, 4-6 representing Development, and grades 7-9 being actual Deployment. Naturally, the higher the TRL, the lower the investment risk.

Investors often encounter competing investment opportunities with similar TRLs. To mitigate risk in these situations, hedging can be a valuable strategy. For example, consider the Tyre Collective and the SMART Tire Company. Both are working to reduce the environmental impact of the automotive industry, and both could be considered in the same TRL bracket. If SMART Tire Company successfully scales its elastic tire technology, traditional rubber tires might become obsolete. On the other hand, if rubber tyres remain the standard, the Tyre Collective's tire wear collection device could become a regulatory requirement, boosting its market potential.

By investing in both companies, an investor can hedge their bets and increase their chances of success, regardless of which technology ultimately prevails.

In a similar vein, I have hedged my bets on content writing platforms by investing in Substack, but I am also using Ghost to host my articles. Feel free to share your examples of ‘hedging pairs’ in the comments.

Breaking down barriers: Equitable access to Climate investing

Historically, angel and venture capital investing has been a domain primarily accessible to the wealthy. The requirement for a net worth of at least $250,000 (excluding primary residence) to qualify as an accredited investor has created major barriers for lower-income individuals, especially in the Global South.

Fortunately, the emergence of equity-based crowdfunding platforms like Wefunder and Crowdcube has democratized private investing by lowering the minimum ticket size. This has helped provide more people with the opportunity to invest in private companies. These two platforms list companies from all sectors. Climate Insiders is a complete climate-focused and equity-based crowdfunding platform. Unlike the other two, it charges an annual subscription fee to access investment rounds.

Climate founders also have a responsibility to use crowdfunding platforms to raise capital, rather than relying solely on traditional venture capital firms. This can help to counter the effects of "VC gatekeeping," which can unfairly exclude lower net worth investors. I have experienced the frustration of being unable to invest in promising climate tech companies due to accreditation requirements. However, crowdfunding platforms have allowed me to support some of the businesses discussed in this article.

What are your thoughts on this article? Feel free to share them in the comments.

We would really appreciate your monetary support if you enjoyed reading this post and found it insightful.

PS: This article has been edited by Anjaly Raj.

This work is licensed under CC BY-SA 4.0